Grain Traders Await Key USDA Report on August 12. Big US Corn, Soybean Crops Expected.

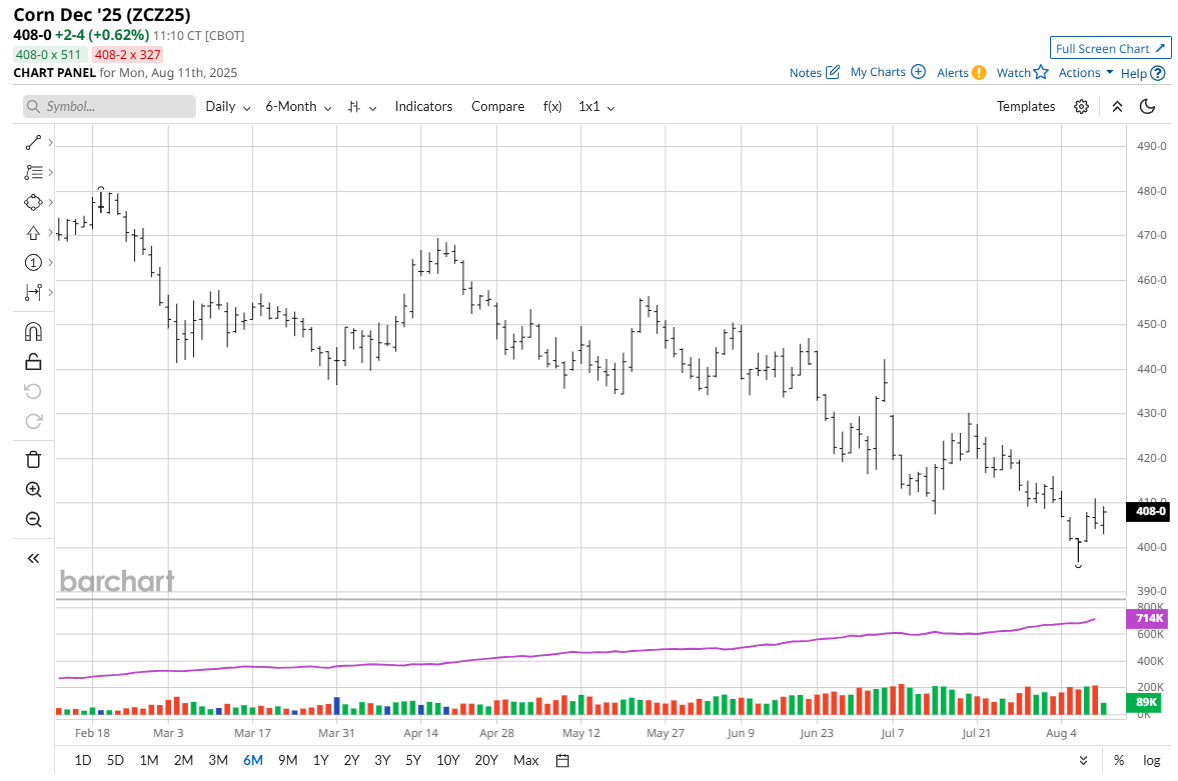

Grain futures markets trading action may be muted on Monday ahead of what is arguably the data point of the month for the grain markets: Tuesday’s USDA monthly supply and demand report. Huge and even record yields could be forecast for U.S. corn (ZCZ25) and soybean (ZSX25) crops.

A Dow Jones Newswires survey of grain analysts shows they expect U.S. corn production this year at 15.991 billion bushels, with an average yield of 184.3 bushels an acre. The record for U.S. corn production, according to USDA, is the 15.186-billion-bushel crop grown in 2024, with a record average yield of 183.6 bushels per acre. The Dow Jones Newswires survey expects U.S. soybean production in 2025 at 4.371 billion bushels and an average yield of 53.0 bushels an acre. U.S. soybean production in 2024 totaled 4.37 billion bushels, which was also a record. The average yield per acre was 50.7 bushels,

Bearish USDA Data Expected for Corn and Soybeans, But…

Price action in corn and soybean futures early last week saw significant selling pressure, with December corn hitting a fresh contract low and November soybeans scoring a four-month low.

However, by the end of the week both markets had stabilized, suggesting that the bears had become exhausted, especially in the corn market. I suspect traders last week were factoring into futures prices the expected bearish USDA crop report on Tuesday. Such suggests that a classic “sell the rumor, buy the fact” scenario may play out following Tuesday’s crop report.

U.S. Midwest Weather Still Leans Bearish for Corn, Soybeans

Weather in the U.S. Corn Belt is still non-threatening, with generally adequate soil moisture levels and rains still falling in the region. Weather forecasters say such will likely be the case for at least the next two weeks. There will also be a lack of widespread heat for at least another week. Warmer- to much-warmer-than-normal temperatures will be most common through the next week, but widespread, excessive heat is not expected, according to weather forecasters. August is arguably the most important growing month for most of the U.S. soybean crop.

Export Demand for U.S. Corn Picking Up Steam

USDA last Friday reported another daily U.S. corn sale of 125,000 metric tons of corn to unknown destinations during the 2025-26 marketing year. Last Thursday, USDA reported weekly old-crop U.S. corn sales of 170,400 metric tons for 2024-25 for the week ended July 31, down 50% from the previous week and down 71% from the four-week average.

However, new-crop corn sales totaled a solid 3.163 million MT. The 2025-26 marketing year corn export sales pace is now more than double the rate seen one year ago at this time. It may be difficult for corn market bears to continue to press the downside in corn futures if the U.S. corn export sales pace continues to be strong.

October will find the U.S. corn harvest in full swing, and with a bumper crop expected, rallies and an extended price uptrend in corn futures will likely be limited by commercial hedging pressure. A better handle on the size of the U.S. crop will also come likely at that time, with combines rolling and yields from farmers rolling in.

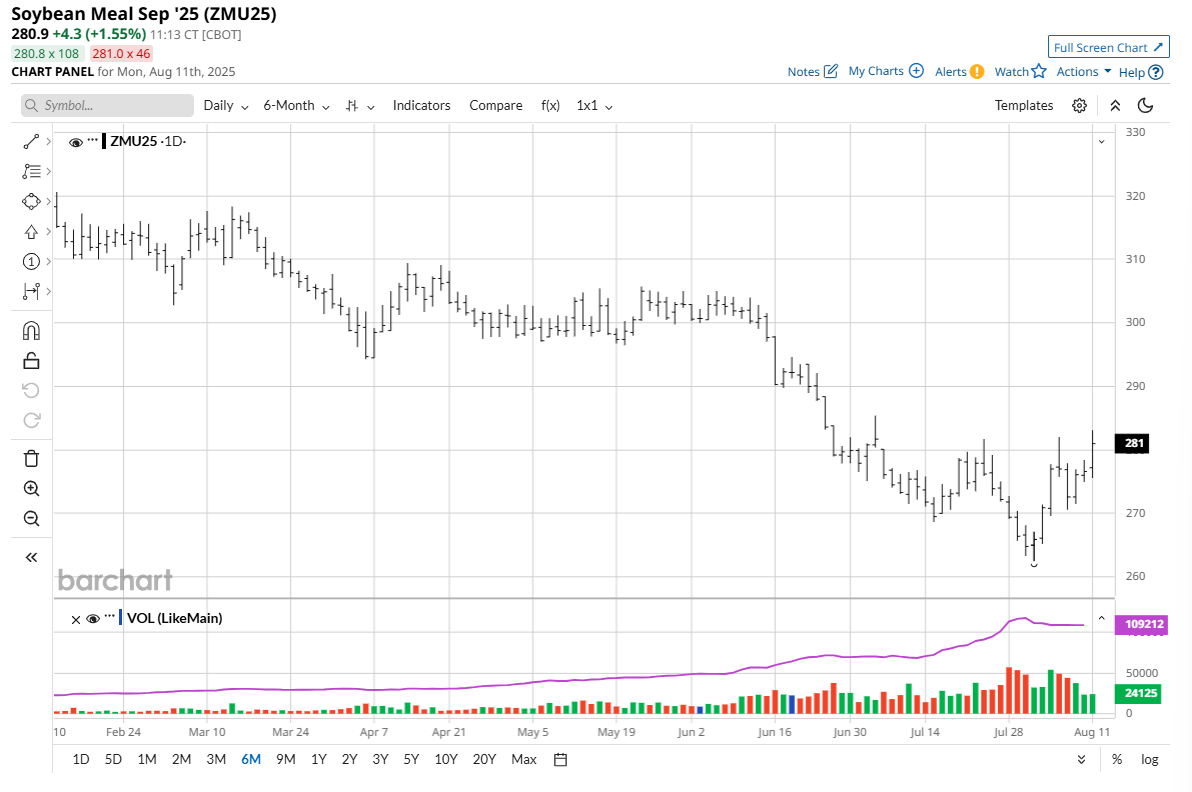

Soybean Meal Futures Providing Early Bullish Clues

The soybean meal futures market had a good week last week, as spreaders unwound long bean oil (ZLU25), short meal (ZMU25) trades. If meal continues to perform well this week, that would be an early sign the soybean futures market has also put in a near-term low.

Soybean bulls continue to anxiously await new-crop purchases from China. If the U.S. and China agree to a trade deal in the coming weeks or few months, the soybean market likely would get a significant price boost. Conversely, a deterioration in U.S.-China trade relations would be a bearish weight on the soybean futures complex.

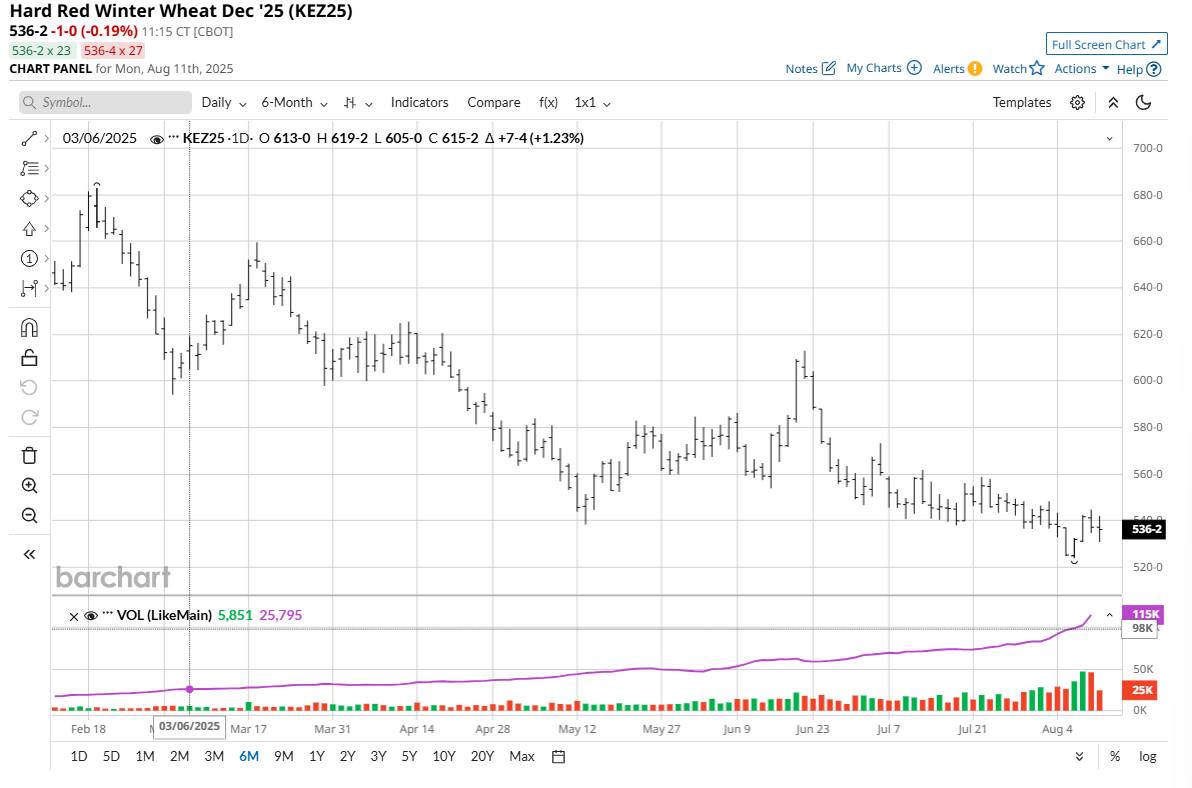

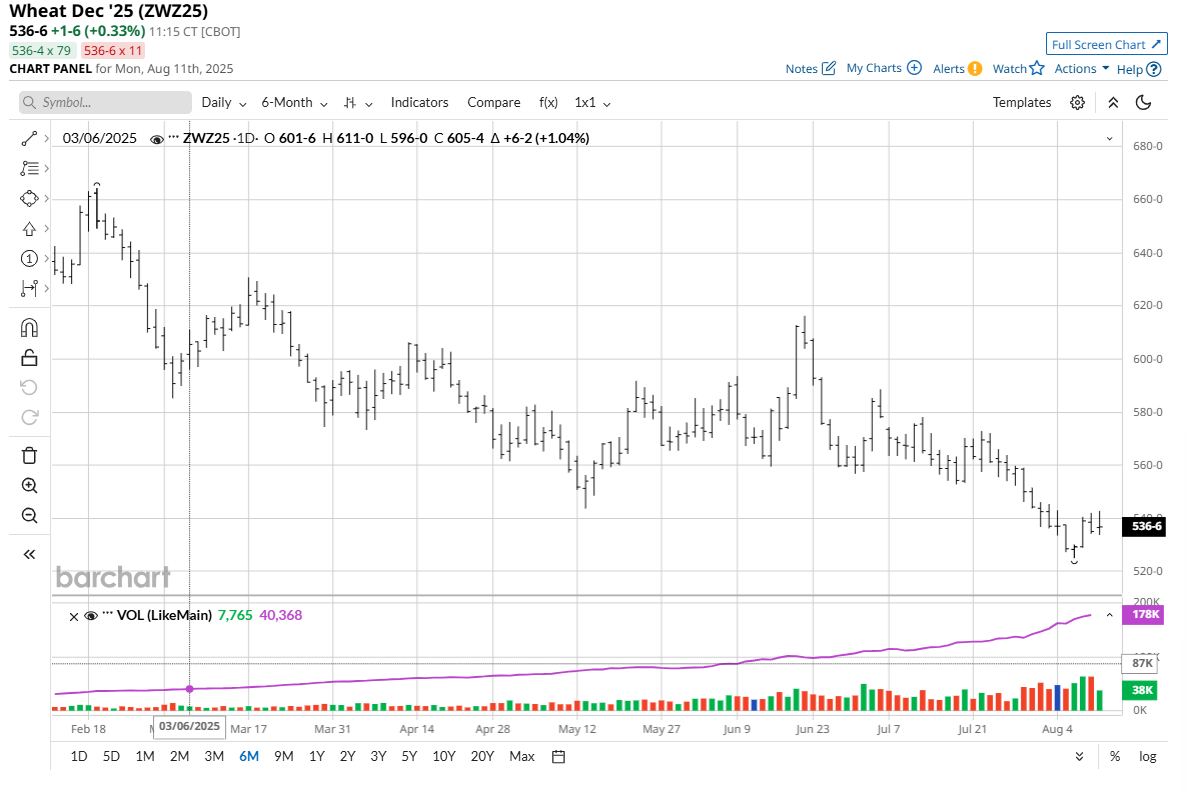

Wheat Market Bulls Are Still Struggling

After swooning to contract lows last week, the winter wheat futures (KEZ25) (ZWZ25) markets posted decent rebounds Wednesday and Thursday and saw just modest corrective pullbacks Friday. Key for the bulls this week will be to show some price strength to better suggest near-term market price bottoms are in place. Wheat traders will be looking to the corn market for daily price direction.

Tuesday’s midday USDA supply and demand report is also in focus for wheat traders. The Dow Jones Newswires survey of grain analysts shows they expect all U.S. wheat production to come in at 1.925 billion bushels.

U.S. wheat harvesting weather has been favorable in the Midwest and northern Plains. Harvesting in the central Plains is winding down. The Canadian Prairies wheat region has seen some dry weather that hurt wheat production potential.

USDA last Thursday reported weekly U.S. wheat sales of 737,800 MT for the week ended July 31, up 25% from the previous week and four-week average. Sales exceeded pre-report expectations. U.S. wheat sales abroad will need to continue to improve in the coming weeks to get the winter wheat markets out of their slump and possibly begin sustainable price uptrends.

U.S. winter wheat harvest will be mostly completed in the coming weeks, which suggests less commercial hedging pressure on futures prices. The wheat market bulls will be looking to new trade deals between the U.S. and other countries, including China, to potentially boost U.S. wheat export prospects in the coming months.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.